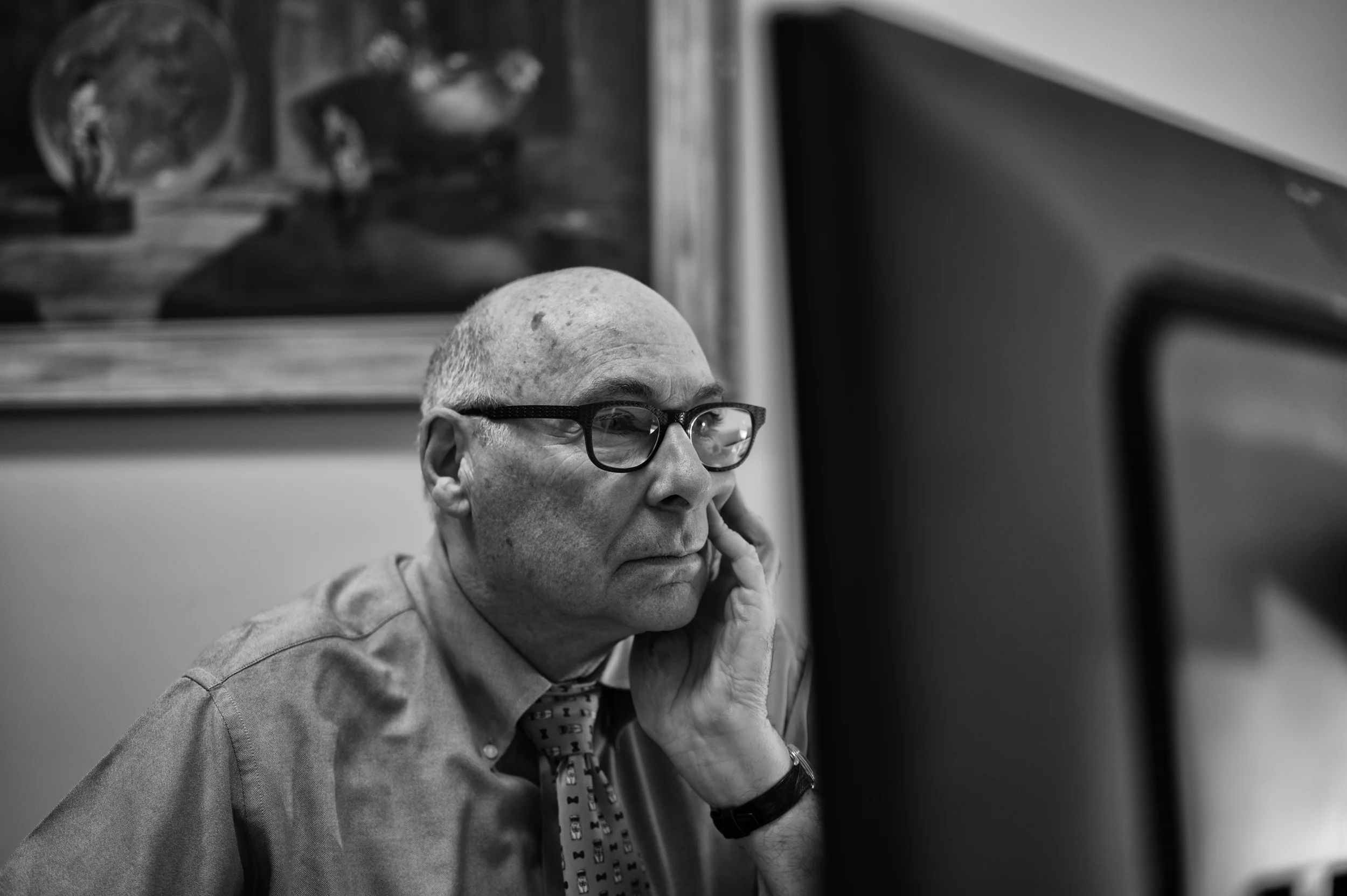

By Peter H. Cass

Disclaimer: This article is not a substitute for legal advice. No action in regard to your particular matter should be taken until you have first sought full legal or professional advice from a lawyer fully retained to act on your behalf.

The subject of this article is Letters of Intent (“LOI”) from the point of view of the buyer of assets or shares, followed by the point of view of the seller.

From The Point of View of The Buyer

A buyer can expect to be asked to sign a Non-Disclosure Agreement (“NDA”) so that they can receive enough information to decide on price, timing, and other key terms of the purchase. The “wise” buyer has a “Lock-up Clause” requiring the seller not to negotiate with anyone else during a specified time frame or window. What the Lock-up Clause does is keep other buyers away, which is a huge advantage in the negotiations. Once you have a letter of intent signed, then you will be able to figure out whether the asking price is reasonable or not. You will also be able to check in with your accountant. Taxes always matter, as they differ between an asset purchase and a share purchase.

Typically, you can renegotiate the terms of the letter of intent based on that new knowledge. However, that is not always true, because once the negotiations have progressed to the point where you can do an asset or a share purchase agreement, the parties normally try to stick with the letter of intent terms. Keeping open channels is one of the major reasons why, in most deals, both parties benefit from a strong relationship based on trust and communication.

From The Point of View of The Seller

While a letter of intent is not binding, except for terms about confidentiality, my experience is that purchasers do not usually go to the trouble of drafting and signing a letter of intent unless they have a genuine interest in completing a transaction. Even so, a seller should not agree to an overly long Lock-up Clause while sensitive information is protected. If negotiating with an actual or potential competitor, extra caution is a must. While a buyer may attempt to renegotiate the LOI terms, once it’s signed, the seller can also do that.

For both parties, trust is a major requirement for a successful transaction. Psychology is always a factor. Keeping open channels allows both parties to benefit from a strong relationship based on trust and communication, enabling direct negotiations that often produce better results. So, consider that factor in deciding whether negotiations will be direct, involve the accountants, or done through the lawyers. In making that choice, delay is as important as trust, to keep a transaction moving towards completion.

A seller should know, before the letter of intent is signed, what is the best structure for tax purposes. There can be rollovers and re-organizations that create a much better after-tax result. You can sometimes sell for less if the net proceeds are higher because of how the deal is set up.

For more information or legal advice on Letters of Intent (“LOI”), you can contact Peter Cass, here.